Business generation can stem from utilising the allowances SARS gives.

Posted in Broker In Your Pocket on Feb 20, 2023

With the tax year coming to an end, now is an opportunity to sit with your broker and work out a strategy to utilise the allowances provided from SARS and how you can benefit from them.

Your broker can work out your availability spend to provide you with a game plan for the year ahead. The easiest way is to top-up your Retirement Annuity (RA) for the year and that will be our assumption before visiting the tax rebate from SARS.

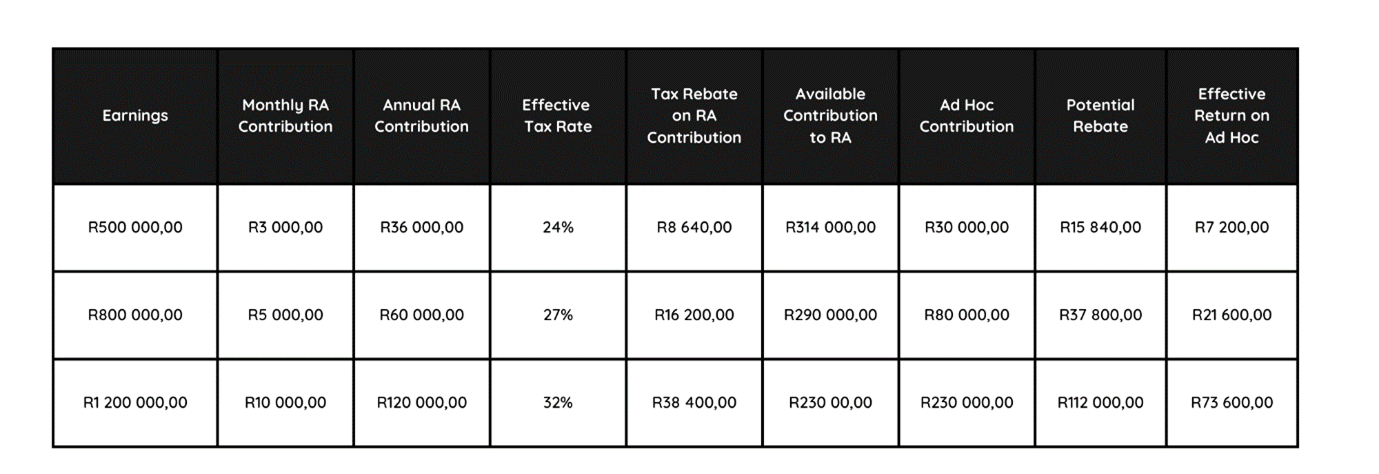

In the below examples, we can visually see how being clever with your RA investment can benefit you in the long run, especially with limiting your tax exposure.

By making use of the R350 000 threshold from SARS into your RA, you can top up the investment over the year and benefit from the increased tax rebate, which is then taken off of your annual tax submission. This lowers your exposure to SARS and increases your investment. This is an incredibly under-utilised tool by investors to minimise their marginal tax rates each year. Your RA becomes essentially a means to lower your tax obligations.

When reinvesting your SARS return as a lump sum into your RA, you can increase the value of your RA and benefit by creating a tax pocket in retirement.

The prudent way of utilising your tax rebate can be viewed in three ways:

- Reinvesting your tax rebate back into your Retirement Annuity This creates a tax pocket within your RA, meaning you don’t pay tax again on that reinvested amount, when you draw down in retirement.

- Tax free Savings Account By investing the rebate into your TFSA, the money becomes liquid, and you are creating a tax shelter for your investment growth in the fund.

- Investing your tax rebate into an offshore recurring dollar platform

By making use of this option provides you an opportunity for your lump sum investment to generate.

- Offshore exposure

- Conversion of rand to dollar

- Tax levied on an offshore investment is more favourable than a local investment and is thus efficient use of the tax rebates.

To summarise our brokers, want to assist you by taking your available tax allowance and create minimum tax exposure and maximum investment in yourself.